Is Google’s dominance of the $300 billion search industry over?

The Wall Street Journal claims Google’s dominance of the $300 billion search advertising market is slipping as new challengers emerge in their article, “Google’s Grip on Search Slips as TikTok and AI Startups Mount Challenge”.

Some of the challenges Google faces as claimed by WSJ are:

- The antitrust pressures placed on Google from the DoJ

- The rise of TikTok

- User behaviour shifting to usage of AI search engines, like Perplexity or ChatGPT.

A few recent updates could support this claim:

- Google has received what they call “radical and sweeping proposals” from the DOJ that “risk hurting consumers, businesses, and developers.”

- TikTok recently introduced a feature that provides marketers with the ability to target ads based on users’ search queries. This is a similar model to Google’s AdWords, and something TikTok wasn’t offering until recently.

- Perplexity, the AI-powered search engine that is set to introduce ads alongside AI-powered answers. Perplexity already monetises with a $20-a-month subscription but with the new ad-powered model, this could WSJ claim divert resources away from Google.

Let's reflect on each of those factors.

The antitrust pressures placed on Google from the DoJ

In October, we learned that the DoJ is ordering Google to:

- Break out Chrome and Android as separate businesses

- Share user search queries, clicks, and results with competitors

- Impose restrictions on Google’s use of data to build AI tools

- Make changes to it’s online advertising products

- Limit distribution partnerships with Apple and others so users have more choice in which search engines they use.

According to Google’s response, this would have a major impact on their business. The press release by Lee-Anne Mulholland on their blog, The Keyword, makes it clear this would pose a major threat to how much value they can provide as a business.

So Google’s search ad market dominance may very well be under pressure from the DOJ trial. But they will battle this in court in 2025, so any immediate changes are unlikely for marketers to worry about.

The rise of TikTok

Another question you might ask is how are TikTok and Perplexity stealing that much search ad market share off from Google?

TikTok has only recently launched a search query-based targeting functionally. So it’s unlikely that advertisers will have had time to experiment with shifting all their budgets here just yet.

We also shouldn’t forget that ByteDance - the Chinese company that owns TikTok - is being forced by the US government to sell TikTok to a US-based company by January 2025. This may result in hesitance from marketers in shifting their ad budgets across.

User behaviour shifting to usage of AI search engines, like Perplexity or ChatGPT

When we consider the rise of AI search and the claim that users will navigate to those tools over Google, I recently calculated that Perplexity has 0.1% of Google’s active users based on Dmitry Shevelenko, Perplexity’s chief business officer’s interview with the Financial Times in August.

Perplexity is an exciting tool, showing the potential of how generative AI can create a delightful search experience but it’s faced a number of legal challenges and still lacks the authority and trust that Google has built. Those are the main problems with AI search: accuracy, misinformation and therefore trust from users to use it as their main search engine.

On top of that, Google is rolling out tons of AI search features as they attempt to disrupt their business from the inside, such as AI overviews and AI-organised search results. If users find AI search valuable, why not just keep using Google’s AI search features?

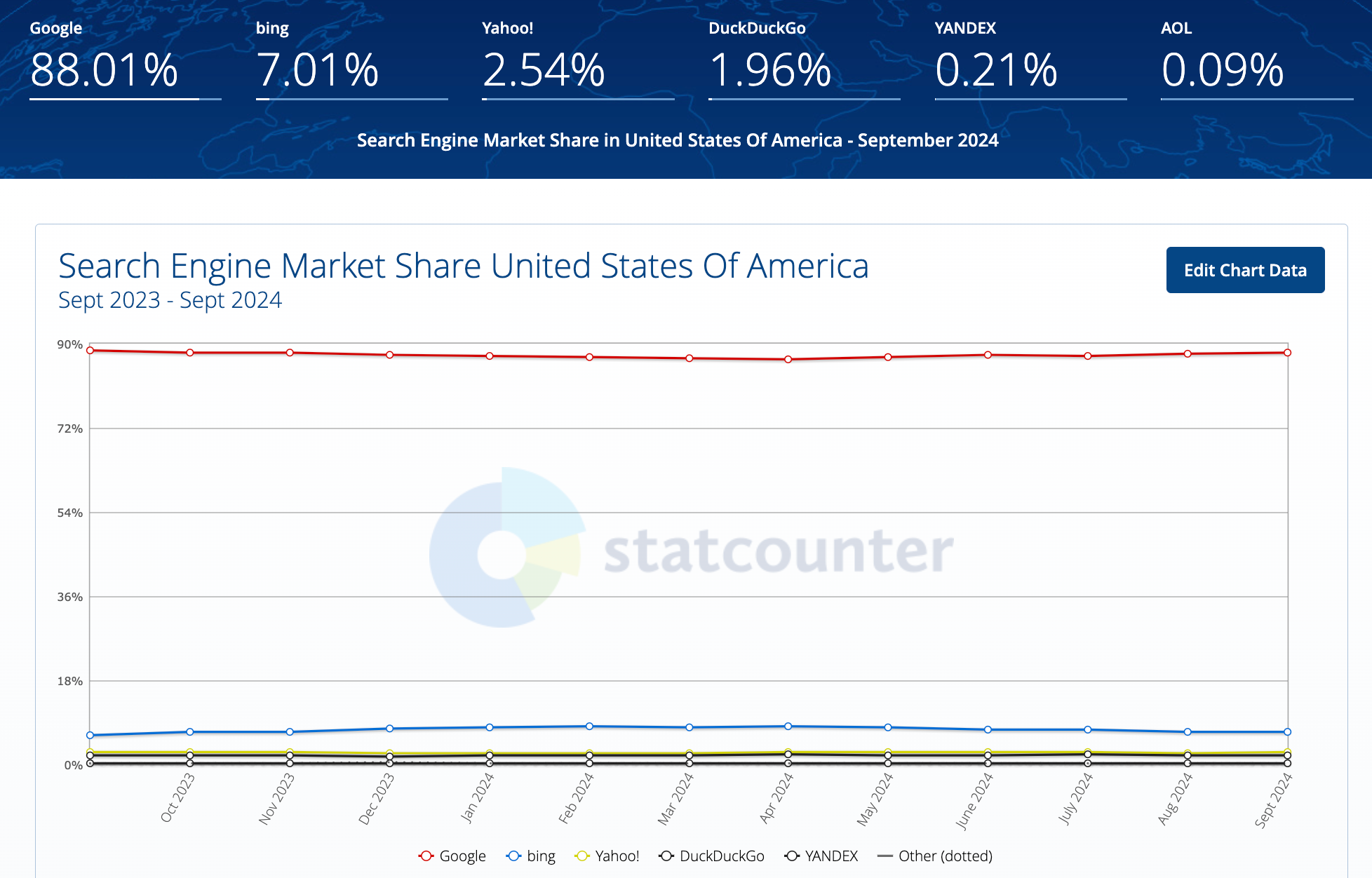

Google still has 88% of share of Clickstream data vs. competitors (SparkToro, Datos)

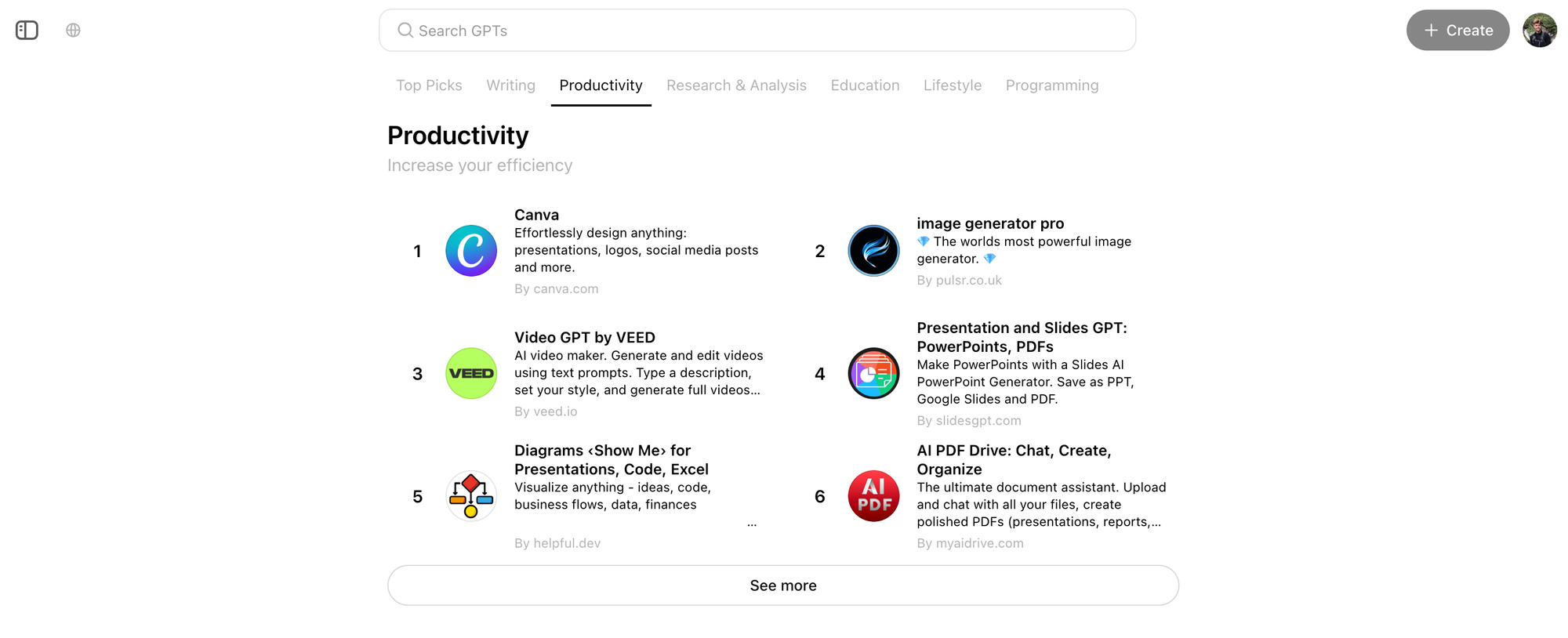

In response to WSJ’s claim that Google’s market dominance will decline below 50% in 2025, Rand Fishkin did a piece on SparkToro, “Is Google losing Market Share?” and he pulled ClickStream data showing Search Engine Share in US (September 2024):

- Google: 88.01%

- Bing: 7.01%

- Yahoo: 2.54%

- DuckDuckGo: 1.96%

- YANDEX: 0.21%

- AOL: 0.09%

Rand basically calls out the WSJ’s eMarketer source as making overblown claims of Google’s demise, but points out the growth across the likes of Instacart, Apple, Hulu and Spotify who are nipping at Google’s heels.

What do I think this means for marketers?

I think that there’s a lazy narrative that the Media have led with this year in response to the generative AI boom that goes something like: Google is declining and everyone is switching to use AI chatbots or native AI search engines to solve their problems.

It gets clicks.

I do not think that the majority of people are using AI chatbots to search for things and replacing their old habits just yet, and when you compare the active users on AI search engines like Perplexity at 0.1% of Google, you really see how dominant Google is.

So, you shouldn’t divert resources away from investing in Google right away.

However, the ROI of your SEO efforts on Google may have declined in the last 24 months as Google has responded to the generative AI threat to the quality of their search results.

Paid search should still reach a huge TAM, and even with SEO’s ROI declining, it’s still a highly valuable channel to build on for long-term, sustainable content-led growth.

I do think that if you market a product or service that has a technically-savvy target audience, or more broadly in the tech industry, then you should be starting to seed investments in these new and emerging AI search channels like ChatGPT’s GPT Store, Perplexity and others.

I also think the opportunity to reach audiences on TikTok via search query targeting is a good one for marketers who are already using TikTok to successfully reach their customers organically. I’m not a TikTok expert, but I think marketers should think carefully about the type of ad creative they would use on here, especially when paying for reach.

Whilst any audience building may be in vain if TikTok ends up being banned in the US.

I suggest marketers do keep a close eye on the DOJ trial, but it will be years before the outcome of that is felt and it’s unlikely going to change how users search immediately as they have long established habits of “Googling” something.

Ultimately, Google’s search dominance doesn’t need to collapse - as the publications will write about to get clicks and impressions - for marketers to experiment investing in new and emerging channels across AI and social media.

What do you think? Do you buy into the narrative Google is declining and about to face its bitter end? Do you think it’s all overblown by AI bros and click hungry publishers? Or do you think it’s somewhere in between.

Let me know in the comments!

Rory Hope Newsletter

Join the newsletter to receive the latest updates in your inbox.